Typically, you have a short-term forecast that gives you visibility into the near future and a long-term view that assists you with larger plans. Please note that this report type is currently only available in QuickBooks Desktop Edition, not QuickBooks Online Edition. Following these best practices will lead to better utilization of cash flow data and active management of financial health over time. Maintaining an up-to-date cash flow statement also provides key insights when applying for financing. It demonstrates the ability to generate sufficient cash to service debts. QuickBooks Online users also have access to the cash flow statement report.

- Profit refers to the difference between revenue and cost over a period of time, whereas cash flow measures your cash on hand.

- It directly tracks actual cash transactions, providing a real-time view of cash movement.

- If your business purchases or sells an asset for cash, you’ll post the impact here.

- To create a cash flow statement manually, select a time period and review your income and expenses in each of the three activities discussed above.

Use a cash flow statement as well as cash flow projections to clarify your company’s position on cash. If you have any concerns about creating or understanding your cash flow statement and projections, work with a CPA or other knowledgeable financial specialist. Improve your cash flow with invoices, payments, and expense tracking. Use QuickBooks free cash flow statement template to clarify your company’s position on cash. If you have any concerns about creating or understanding your cash flow statement and projections, work with a CPA or other knowledgeable financial specialists.

Why do You Need a Profit and Loss Statement in QuickBooks

If you haven’t already, consider using our free template to craft a new business plan that addresses your needs and goals as a growing business. As a valued client, you get a secure, password-protected portal to store and access your important financial documents from anywhere at any time. With this great new feature in QuickBooks Desktop 2021, you will easily meet both types of Statement use requirements in a time-saving way that boosts productivity. Remember, you can set up as many different Statement schedules and statement related customer groups as you need. Next, set up the mapping of the file column related to the QuickBooks field.

- Maintaining an up-to-date cash flow statement also provides key insights when applying for financing.

- If cash flow is causing a delay in paying your vendors, you may be able to negotiate the payment terms or delay paying bills until you have the cash.

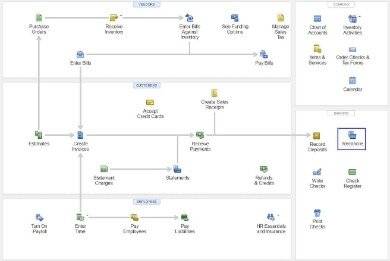

- We’ll tell you what types of financial statements are available on QuickBooks, what they’ll tell you about your business and the instructions you need to follow to access them.

- They include cash along with any liquid investments you can quickly convert into cash.

- A cash flow statement lists the cash inflows and outflows of cash for a period of time, and the ending cash balance is the same dollar amount reported on the balance sheet.

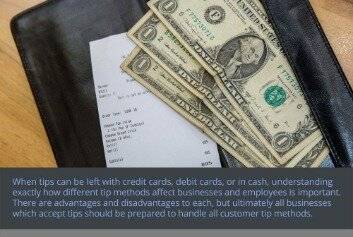

- The cost of replacement should be included in the restaurant chain’s annual budget.

Download QuickBooks cash flow statement template no matter what type of business you have. Our cash flow statement template can be customised to include the specific types of cash flow activities that apply to your company. QuickBooks free cash flow statement template with built in calculations is a great tool to help your business manage its cash flow.

QuickBooks Support

Please let me know if you have additional concerns related to running reports. While we assess this, I suggest sharing your suggestion directly with our product developers. We always make improvements in the product, and this preference might be added in the future.

It’s important to identify the key cash drivers for your company’s operations, as well as understanding how the current period (i.e. month, quarter, or year) compares to a prior period. This template helps you outline those drivers by comparing the current and prior accounting periods in detail. A cash flow statement can provide a clearer picture of your company’s ability to pay creditors and finance growth. This method deducts cash out from cash in by focusing on cash inflows and cash outflows of cash from operating activities. In most small businesses, revenue doesn’t always match up with spending, so understanding your cash flow is critical.

Cash Flow Statement Direct Method

If your business purchases or sells an asset for cash, you’ll post the impact here. To create a cash flow statement, review each cash transaction on record, and assign the dollar amount to one of three categories. In either case, QuickBooks Users frequently forget to send out Statements, or they forget to send them out promptly to notify their customers of payments due. Users frequently use a different Statement template for each of the two different Statement purposes, one as a reminder for overdue invoices, and a different template for recurring statement charges.

With solid historical data from QuickBooks and thoughtful analysis in Excel, businesses can reliably forecast cash flow to inform financial decisions. By fully leveraging the cash flow statement and planner in QuickBooks, you gain the insights needed to understand your liquidity, spot issues early, and strategically guide your business finances. Consistently monitoring and interpreting cash flow trends is vital for making sound financial projections and plans. Monitoring your cash flow using this formula gives you an ongoing picture of your available cash and where it is coming from and going to. This helps guide financial decisions to keep your business financially healthy. Our partners cannot pay us to guarantee favorable reviews of their products or services.

Creating Company Financial Statements

As such, Statements need to be sent out in two different batches so the templates can be segregated. There is a bug that exists in QuickBooks that makes the Cash Basis Balance Sheet appear off balance if discounted transactions are coded to accounts for balance sheets. While it’s us recession on the horizon when experts think it could hit similar in that it provides financing options for a product or service, loans are typically issued by financial institutions like banks and credit unions. You can rest assured that we will work closely with you to create actionable business plans and accurate financial reporting.

Free Cash Flow Statement Template

From this Add Reminder window, you will tell QuickBooks, ‘When you want to send this reminder” by choosing how many days before or after the statement date to send the reminder. You will also select the ‘statement period’, the level of detail you want included on your statements, and the statement template and Email template you want to use for this specific Customer group of Statements. There are at least two different kinds of QuickBooks Users that utilize the Statements feature.

Identifying Trends with the Cash Flow Planner

A balance sheet report gives a financial snapshot of your company as of a specific date. It calculates how much your business is worth (your business’s equity) by subtracting all the money your company owes (liabilities) from everything it owns (assets). The cash flow statement is one of the three necessary statements to meet GAAP requirements. Being able to see your cash flow on a month to month basis is basic information needed to manage your business.